bbs.ebnew

标题: 政府采购法律和政策(二):加拿大【转贴】 [打印本页]

作者: zxc1981 时间: 2015-12-14 21:16

标题: 政府采购法律和政策(二):加拿大【转贴】

政府采购法律和政策(二):加拿大(上)

I. 国际协定

A.引言

加拿大是很多双边和多边国际政府采购协议的参加方,该国政府为特定供应商和服务商建立了一套规则,以便外国参加方互相扩展市场,但仍然严格限制各自的市场准入。这些协议中最重要的两个是世界贸易组织(WTO)多边政府采购协定(GPA),以及三边的北美自由贸易协定(NAFTA),它们的条款都已被吸纳进加拿大国会通过的国内立法实践中。 B.WTO

世界贸易组织(WTO)公布了政府采购协定(通常简写为GPA,而不是AGP)各参加方提交的附录和附加条款,对加拿大而言,附录I列举了81个联邦政府实体,包括绝大多数的 中央实体,这些实体通常与GPA相绑定,还有一个涉及货物的清单,除了特别豁免的国防部和加拿大皇家骑警外,其他实体采购货物清单内的产品都适用该协定。 附录二将出价范围扩展到加拿大省级实体,但有一些特例,例如对涉及次中央实体的双边协定,将规定推进环境质量的限制条款,但是目前还没有此类协定得以签署,因此,这一清单里没有添加任何省份。这与美国形成鲜明对比,美国已经在这个清单中添加了37个州,虽然目前GPA中还缺少次中央实体的政府采购规定。

附录三添加了包括加拿大邮政公司在内的三个政府企业,以及四个博物馆,然而,与附录二一样,附录三目前也对加拿大没有约束力,因为出价各方尚未就包括企业达成协议,诸如皇家所有的公司等就不被认为是“实体”。同样的,附录四确保将特定的非工程类服务项目加入出价清单,包括法律服务、会计服务和软件应用等;附录五允许将绝大多数建筑服务纳入GPA。 加拿大还提交了“总备注”,从根本上概括了加拿大对GPA中所包含限制和例外的理解和解释,加拿大在其附录和附加条款的克减范围中对此进行了确认和添加。这个总备注认为,该多边协议“采购过程不包括非合同性协议或者任何形式的政府援助,包括(但不限于)合作协议、补助金、贷款、股本注入、担保物、财政激励及政府提供给个人、 公司、私人机构和地方政府的货物和服务”。恰如所见,这种管辖正是美国在其经济刺激政策包中所引述和包含的保护“购买美国货”合法性条款。“总备注”还阐明,“所列服务开放范围遵循对等开放原则,直到GPA所有成员就服务清单相互达成一致的立场”,对于欧盟国家,GPA不适用于饮用水、能源、交通和电信领域的活动,因为欧盟在这些领域的政策也设有限制。

C.北美自由贸易协定(NAFTA)北美自由贸易协定(NAFTA)签字仪式

从1999年起,加拿大对美利坚合众国的直接商业出口份额,从占加拿大的总出口份额的几乎90%降到了大约75%。尽管如此,2008年两国之间的双边贸易额大约为6600亿美元,报告显示,这是世界上最大的双边贸易关系。因此,美国到目前为止仍是加拿大最大的出口市场,对加拿大经济有生死攸关的重要性。加拿大也是美国最大的贸易伙伴。实际上,加拿大对美国货物和服务的采购量是美国对加拿大采购量的两倍,尽管这个国家只有3500万常住居民,却是美国第三大贸易伙伴。其中一个原因是加拿大和美国都互相从对方进口大量工业制成品或部分成品,这些半成品也被包括在完成品中,这在汽车行业中尤为真实,两国汽车行业直到1960年代才分开。

从1994年起,规范美-加贸易关系的主要机制就是北美自由贸易协定(NAFTA)了。在198 9年到1994年期间,美国和加拿大之间的贸易关系是由加拿大-美国自由贸易协定来规范的。墨西哥加入进来后,这个初始协议就被NAFTA取代了。从最初的美加双边协定生效,两国之间按美元计算的贸易额就翻了一倍。

NAFTA第10章重点规范政府采购。它最初的意图是在现有的加-美自由贸易协定和现有的关贸总协定政府采购条款的基础加以扩展,但第10章仍然比GPA有更广的适用范围。然而,在GPA和第10章之间仍然有很多相似点。两者都有门槛价:对GPA来说,WTO公布了一个列表,基本列表用“特别提款权”(SDR)的形式给出了门槛价,但这些仍然换算成了各国的流通货币。对于NAFTA来说,政府实体货物和服务合同的门槛设定为5万美元,工程项目的合同门槛价是650万美元;政府企业货物和服务合同的门槛价定为25万美元,建筑工程项目合同门槛价是800万美元。然而,这些初始数字已经因为通货膨胀而调整,在美国和加拿大,联邦部门和机构从两国供应商那里采购货物和服务的门槛价已经降低到25000美元,这些优惠不扩及墨西哥供应商。对墨西哥供应商来说,报告称他们的门槛价大约是56000美元。然而,即便是这个数字也比GPA中的相应数字低得多。事实上,GPA和NAFTA中门槛价的对比说明后者一直相对较低,这意味着,美国供应商应用NAFTA政府采购条款,通常比应用GPA政府采购条款拥有更大的机会进入加拿大市场。

因为按照政府采购条款的优惠政策,企业比政府实体的门槛更高,了解一个合同是由企业还是政府实体给予的,有时候这很重要。这个问题在加拿大国际贸易审理委员会审理“加拿大总检察长诉Symtron系统公司”案时考虑了进去。在这个案件中,加拿大国防部作为一个政府实体将一份合同授予了加拿大防御工程公司,这是一家企业公司。审理委员会发现,应该应用更低的政府实体门槛价,因为根据合同,国防部将拥有并使用要建设的这个设施,应用企业门槛价接受投标可能被视为规避NAFTA的规定。这个判决最终被加拿大联邦议会确认。

北美自由贸易协定第1003条规定,缔约方必须给予其他缔约方货物和供应商“不低于其他缔约方给予本国货物和供应商或该国给予本国货物和供应商的最优惠”待遇。这就是国民待遇和非歧视原则。

关于原产地规则,NAFTA第1004条规定如下:

“任一缔约方都不得将原产地规则应用于从另一缔约方进口的以本章所涉及的政府采购为目的货物,因为它们该缔约方在普通贸易程序中所应用的原产地规则不同或不一致,后者可能是该缔约方应用于其普通贸易程序中的标记规则。”

这样,NAFTA将通过在政府采购领域禁止采用原产地规则确认了不同于传统国际间贸易的规则,因为政府采购本身就需要采购更大百分比的产自各国国内的货物和服务,包括贯彻关税责任和其他法律责任而进行的贸易活动都没有这么大的比例。第1005条更进一步增加规定,非NAFTA国家个人或公司如果在美国、加拿大、墨西哥三国境内没有实质性商业活动,可以取消给予的优惠待遇。但实体不再此条规定之列,应为大部分都是政府部门或机构。

NAFTA三国

NAFTA还允许缔约国在一系列其他情况下取消政府采购条款给予的优惠待遇。NAFTA伙伴可以取消给予经济制裁国家的供应商以优惠待遇,或者取消没有外交关系国家的供应商的优惠待遇。NAFTA缔约国也可以为了战略和国家安全的目的,或者为了保护健康、安全、道德或者环境等,对费歧视条款做出例外解释。NAFTA还给予成员国优待国内供应、支持中小企业和少数族裔经营的企业、支持研究开发活动以及支持农业、食品项目等方面的权利。

NAFTA的1016条制订了限制投标程序的规则。下列情况允许限制投标:

公开招标不能奏效时;

艺术品;

为保护知识产权;

发生了不可预知的极端紧急情况;

原供应商额外供货;

采购样机;

在日用品市场采购的货物;

采购决策系为应对极短时期内出现的极特别情况;

采购建筑设计竞赛中的优胜方案;以及

采购机密性咨询服务等。

NAFTA第1024条规定,1998年底前就协议的贸易自由化问题开始进一步会谈。很多专家希望尽快商定的一个课题就是州、省和市级的采购,因为在首轮谈判中并未就这个领域达成协议。然而,这方面的谈判至今没有进行。因此,NAFTA也并未包括加拿大的省或美国的州。为什么至今没有这方面的补充协议,原因完全不清楚,但GPA的类似经验显示,是加拿大的省级政府而非联邦政府阻挠NAFTA将管辖范围拓展至次中央实体,为什么各省会如此传统地阻挠北美自由贸易协定的扩张?帕特里克·格雷迪(编者按:加拿大联邦财政部前高级官员)和凯斯林·麦克米兰(编者按:加拿大爱德华王子岛大学教授)认为:

“部分动机是因为忧虑,害怕向外国供应商开放卫生和教育领域的采购市场,因此,加拿大各省拒绝与继续配合联邦政府与美国谈判商定的任何买卖,因为美国继续坚持‘购买美国货’并排除小企业,但是这可能仅仅是说‘不’的借口。

特别有讽刺意味的是,尽管加拿大在北美自由贸易协定下对美国享有特别优惠的贸易关系,但是在美国各州和地方政府采购市场准入方面,却比诸如欧盟国家和日本等其他并不享有优惠政策的国家拥有更少的机会。加拿大的供应商应该为此感谢他们的省级政府。"

然而,两位作者也指出,各省级的领导人也有他们“合法的”考虑,甚至他们在签署NAFTA和WTO政府采购条款时候,没有必要将他们的供应商列为所有“购买美国货”条款的例外,这样,与之完全不妥协的一个协议也并不符合他们的利益。无论如何,正如我们将在第二部分看到的,这种形势将很快发生变化。

原文:

Government Procurement Law and Policy: Canada

I. International Agreements

A. Introduction

Canada is a party to a number of bilateral and multilateral international agreements that establish rules for the procurement of certain supplies and services by national governments that are designed to give foreign parties expanded, but still restricted access to each other’s markets. The two most important of these agreements for Canada, the provisions of which are included in implementing Canadian legislation enacted by Parliament, are the plurilateral WTO Agreement on Government Procurement (AGP)[1] and the trilateral North American Free Trade Agreement (NAFTA).[2]

B. The WTO

The WTO has published the Appendices and Annexes to the Agreement on Government Procurement (which it refers to as “the GPA” instead of “the AGP”) submitted by each party.[3] For Canada, Annex I lists eighty-one Federal Government entities, including most governmental departments and agencies, that are generally bound by the AGP and a special list of goods that are covered if they are purchased by the extensively exempted Department of Defence and the Royal Canadian Mounted Police. Annex II offers to extend the AGP to Canada’s provincial entities subject to certain exceptions as, for example, restrictions designed to promote environmental quality if a plurilateral agreement on subcentral agencies is reached, but no such agreement has been concluded and no provinces have been added to this list. This is in sharp contrast to the United States, which has already included thirty-seven states in its Annex II despite the lack of a plurilateral WTO agreement on government procurement by subcentral agencies.[4] Annex III adds nine Government Enterprises to the AGP, including the Canada Post Corporation and four museums that Canada has offered to include in the AGP. However, like Annex II, Annex III does not currently bind Canada because the parties to the AGP have not reached an agreement to include enterprises, such as Crown-owned corporations, that are not considered to be “entities.”[5] Similarly, Annex IV offers to make certain non-construction services subject to the AGP, including legal services, accounting and software implementation, and Annex V offers to add most construction services to the AGP.[6]

Canada has also submitted General Notes, which basically summarize some of the Canadian understandings or interpretations of the limitations and exclusions contained in the AGP and confirm or add to the derogations Canada has included in its Appendices and Annexes to the AGP. These General Notes state that the Agreement does not cover shipbuilding, urban rail, certain types of electronic equipment, set-asides for small and minority businesses, agricultural support programs, and national security exemptions respecting oil and nuclear technology. They also note that the AGP does not cover “any type of government assistance, including but not limited to, cooperative agreements, grants, loans, equity infusions, guarantees, fiscal incentives, and government provision of goods and services, given to individuals, firms, private institutions, and subcentral governments.”[7] As will be seen, this provision is one that has been cited by U.S. authorities in defense of the legality of the “buy American” provisions contained in the economic stimulus package, which have been widely criticized in Canada. The General Notes also state that the services Canada has included extend only to parties that grant reciprocal access[8] and that for the European Union, the AGP does not apply to activities in the field of drinking water, energy, transport, or telecommunications due to restrictive EU policies in these areas.[9]

C. NAFTA

Since 1999, the percentage of merchandise exports from Canada destined for the United States has actually declined from almost 90% to approximately 75% of all Canadian exports.[10] Nevertheless, in 2008 bilateral trade between the two countries was approximately $660 billion,[11] reportedly making it the largest bilateral trading relationship in the world.[12] Thus, the United States remains by far the largest export market for Canada and a market that is vitally important to the Canadian economy. Canada is also the United States’ largest trading partner. In fact, its purchases of U.S. goods and services are more than twice that of the U.S.’ second and third largest trading partners despite the fact that it has less than thirty-five million inhabitants.[13] One reason for this is that Canada and the United States both import large quantities of manufactured or partially completed parts from each other, which are then included in finished products. This is particularly true in the automotive sector, which has been fully integrated since the 1960s.

Since 1994, the primary instrument regulating U.S.-Canada trade has been NAFTA. Between 198 9 and 1994, trade between Canada and the United States was regulated by the Canada-U.S. Free Trade Agreement. This initial agreement was replaced by NAFTA when Mexico became a party. Since the original bilateral U.S.-Canada agreement went into effect, trade between Canada and the United States has reportedly tripled in dollar amounts.[14]

Chapter 10 of NAFTA addresses government procurement. It was originally intended to expand upon the provisions of the extant Canada-U.S. Free Trade Agreement and the extant General Agreement on Trade and Tariffs Agreement on Government Procurement, and Chapter 10 still has a wider application than the AGP. However, there are many similarities between the AGP and Chapter 10. Both have thresholds. For the AGP, there is a table of thresholds published by the WTO.[15] The basic table sets out the thresholds in terms of Special Drawing Rights, but they are also converted to national currencies.[16] In the case of NAFTA, the threshold for contracts of goods and services for government entities was set at $50,000 for contracts for goods or services and $6.5 million for construction projects; for government enterprises, the thresholds were set at $250,000 for contracts for goods and services and $8 million for construction services.[17] However, these original figures have been indexed for inflation and are reduced to $25,000 for procurement of goods by federal departments and agencies in the United States and Canada for U.S. and Canadian suppliers. This benefit does not extend to Mexican suppliers.[18] For Mexican suppliers, the threshold is reportedly about $56,000.[19] Nevertheless, even this figure is lower than the comparable one contained in the AGP. In fact, a comparison of the thresholds in the AGP and NAFTA shows that the latter are consistently lower. This means that U.S. suppliers generally have greater access to the Canadian market as a result of the government procurement provisions of NAFTA than they do as a result of the government procurement provisions of the AGP.

Because there is a higher threshold for the benefits of the government procurement provisions by enterprises than entities, it is sometimes important to know whether a contact has been offered by an enterprise or an entity. This issue was considered by the Canadian International Trade Tribunal (C.I.T.T.) in the case of Canada (Attorney General) v. Symtron Systems Inc. In that case, Canada’s Department of National Defence, which is an entity, offered a contract for a covered service through Defence Construction Canada, which is an enterprise. The tribunal found that the lower entity threshold should apply, as the Department of Defence would own the facilities to be built under the contract and the use of an enterprise to accept tenders could be seen as a maneuver to circumvent NAFTA’s requirements.[20] This decision was affirmed by the Federal Court of Canada.[21]

Article 1003 of NAFTA provides that the parties must give the other parties’ goods and suppliers treatment that is “no less favourable than the most favourable treatment that a Party accords its own good and suppliers or the goods and suppliers of another Party.”[22] This is the principle of national treatment and nondiscrimination.

As to the rules of origin, Article 1004 of NAFTA states as follows:

No Party may apply rules of origin to goods imported from another Party for purposes of government procurement covered by this Chapter that are different from or inconsistent with the rules of origin the Party applies in the normal course of trade, which may be the Marking Rules established under Annex 311 if they become the rules of origin applied by that Party in the normal course of its trade.[23]

Thus, NAFTA recognizes that the rules of origin may differ from country to country, but prohibits the adoption of rules of origin for government procurement that require a higher percentage of content in goods or services originating in one of the parties than they do for other purposes of the law, including for the purpose of imposing customs duties or tariffs. Article 1005 goes on to add that benefits can be denied to an enterprise that is owned or controlled by persons of a non-party or an enterprise that has no substantial business activities in the territory of the U.S., Canada, or Mexico.[24] Entities are not covered by this provision because most of them are government departments or agencies.

NAFTA allows the parties to deny the benefits of the government procurement provisions in a number of other situations. NAFTA partners can deny benefits to suppliers that are subject to economic sanctions or with which they do not have diplomatic relations.[25] NAFTA parties can also make exceptions to the rules on nondiscriminatory treatment for strategic and national security reasons as well as to protect health, safety, morals, the environment, or intellectual property. NAFTA also gives the parties the right to favor domestic suppliers to benefit small and minority-owned businesses and for research and development activities, as well as to support farm support and food programs.

Article 1016 of NAFTA establishes rules for limited tendering procedures. Limited tendering is allowed:

When open calls have not worked;

For works of art;

To protect intellectual property;

In cases of extreme urgency brought about by unforeseeable events;

For additional deliveries by original suppliers;

To procure prototypes;

For goods purchased on a commodity market;

For purchases made under exceptionally advantageous conditions that only arise in a very short term;

For the winner of an architectural design contest; and,

For confidential consulting services.[26]

Article 1024 of NAFTA provided that talks on further liberalization of trade under the agreement were to commence by the end of 1998.[27] Many experts expected that one subject that would subsequently be addressed was state, provincial, and municipal procurement, since no agreement could be reached in this area in the original round of negotiations.[28] However, this has not yet occurred and, consequently, NAFTA does not bind Canada’s provinces or the U.S.’ states. Why a supplemental agreement has not been concluded is not entirely clear, but it appears from the parallel experience with the AGP that the provinces and not the federal government of Canada have been resistant to the extension of NAFTA to subcentral entities. Why the provinces have traditionally been more resistant to an expansion of NAFTA was addressed by Patrick Grady and Kathleen MacMillan as follows:

Motivated in part by worries about opening up procurement in the health and education sector to foreign suppliers, the Canadian provinces refuse to go along with any deals negotiated by the Canadian Federal Government that allow the Americans to retain Buy American and small business carve-outs. But this may just be an excuse to say no.

It is particularly ironic that Canada, which has a preferential trading relationship with the United States under the NAFTA, has less favorable access to state and local government procurement in the United States than other countries such as the European Union and Japan, which have no such special trading arrangement. Canadian suppliers have their provincial governments to thank for this.[29]

However, these authors also pointed out that provincial leaders had “legitimate” concerns that even their subscription to the NAFTA and WTO government procurement codes would not necessarily exempt their suppliers from all “Buy American” provisions and that an agreement that did not accomplish this may not have been in their best interest. Nevertheless, as will be seen the next section, this situation may be about to change.

本网拥有此文版权,若需转载或复制,请注明来源于政府采购信息网,标注作者,并保持文章的完整性。否则,将追究法律责任。

http://guoji.caigou2003.com/falvzhengce/1714303.html

作者: zxc1981 时间: 2015-12-14 21:25

政府采购法律和政策(二):加拿大(中)

作者:曹守同 编译 发布于:2015-11-27 16:17:23 来源: 美国国会图书馆www.loc.gov/

II.关于“购买美国货”的规定

美国复苏与再投资法案(ARRA)中的经济刺激政策包总体上要求,依据法案投资的建设和公共工程项目中所用的钢材、铁和工业制成品都应当是在合众国生产的。2009年4月3日,(美国)管理和预算办公室(OMB)就复苏法案中的“购买美国货”条款实施问题发布了指导意见。就此直接影响加拿大的指导意见规定,(加拿大)国会研究服务机构的伊恩·弗格森发表评论说:

“可能是因为加拿大省级和地区都没有接受GPA框架下的任何义务,管理和预算办公室(OMB)将加拿大排除在美国各州依据GPA承担国际义务的国家之列以外。这意味着,美国根据再投资法案用联邦的钱投资的各州和地方项目,没有必要采用与GPA框架下的义务相符的优惠方式对待加拿大公司。这样,在参与美国各州和地方政府使用美国联邦刺激基金兴办的公共工程所使用的钢铁和工业制成品项目投标时,加拿大公司很可能无缘竞投。然而,GPA框架下美国的义务确实对加拿大公司参与美国ARRA出资的联邦采购项目投标起作用,加拿大公司可以参与哪些项目合同的竞争。尽管这样,加拿大媒体上还是出现过一些有意思的报道:美国合同方和供应商为了避免‘购买美国货’条款的烦扰,在某些采购项目中越来越多地选择国内合作者。”

美国复苏和再投资法案中包含的“购买美国货”规定,在加拿大引起了极大的担心,美国越来越多的保护主义是众目所见。这种担心在2009年9月加拿大总理访问华盛顿会见美国总统和国会领袖时,得到了或许是最完美的展现:讨论一项能为加拿大供应商带来新一轮高潮的提议。历任加拿大总理对美国国会山并不出人意外,但这次哈珀总理却异乎寻常地强调了这一问题对加拿大的重要性。

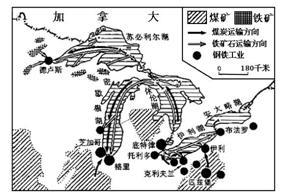

五大湖周围集中了美加两国主要工业制造业,成为美加贸易重要通道

虽然美国人回答说,复苏法案和随后的实施条例都写明,要“与美国加入WTO《政府采购协定》的国际义务,以及美国的自由贸易协定包括NAFTA等规定相一致",但这些不是一种新形式的保护主义。美国已经指定一位贸易谈判代表探寻一种替代方案,大致将加拿大供应商包括进复苏和再投资法案的范围内。

对加拿大抱怨者的批评者也严厉谴责了加拿大各省目前不同意将自己包括进GPA和北美自贸协定的问题。美加贸易关系专家克里斯托弗·桑兹宣称他建议“加拿大官员们与奥巴马政府做一个‘壮士断腕’的生意,因为他们处理‘购买美国货’争议的方式(不能令人满意)”。加拿大官员们认识到,他们不将各省和地方政府加入GPA和NAFTA是一个错误。然而,如前所述,从对各省公平的角度讲,并不清楚将各省和地方政府包括进GPA和NAFTA,能否给加拿大供应商带来更多ARRA方案资助的合同利益,因为GPA和NAFTA的条款中都允许(各省和地方)做出联邦授权的例外规定。

2010年6月,哈珀总理建议各省修改其采购法,允许美国供应商的商品和服务享有NAFTA政府采购条款有关优惠。省级采购市场对美国公司开放的边界尚不清楚,因为很多省市的限制是采用的政策的形式,更多地取决于个人招投标者而不是写在纸上的法条。而且,加拿大市长联盟也在2010年6月以189票对175票通过决议,禁止对加拿大商品施加贸易限制国家的公司参与投标。这是无附加前提的决议,但是暗示很多加拿大市长相信加拿大公司应该允许参加美国ARRA资金赞助的货物和服务采购项目,虽然加拿大并未列入GPA和NAFTA并未覆盖其次中央实体和中央政府授权的次中央实体国家之列。加拿大市长联盟的这项决议在加拿大通过媒体广泛传播,但被加拿大中央政府视为一种抗议的表达,而非最终能对美国供应商起到明显作用的重大努力。

唯一一位对哈珀总理签署一项双边组采购协议的要求立刻做出积极回应的省级领导人是魁北克省省长。魁北克省对保守党联邦领导人的支持是出人意料的,因为虽然该省是自由党政府,但魁北克传统上一直是NAFTA的强有力支持者,部分因为该省拥有相对强大的制造业基础。通常对哈珀总理的提议反对声浪最高的群体是有组织的劳工,例如,2009年8月,加拿大汽车工人协会主席号召其他省份的省长们拒绝一项联邦提议,该提议可能取消或限制各省制定有利于加拿大经济的地方政策的权力。他所代表的各种劳工组织发布了一项声明,内容如下:

“不是要去攻击成功且广受欢迎的‘购买美国货’政策,加拿大政府应该增加投资,迅速设立基金支持公共基础设施,并为这些基金项目贴上‘购买加拿大货’的标签。

我们反对将NAFTA扩展到所有的次国家级采购,反对与欧盟国家谈判缔结‘自由贸易’协定的任何努力,这也会把所有次国家级政府绑到与NAFTA类似的各种限制中。这些办法将吸干加拿大经济的活力,恶化制造业目前的危机,并且干扰省级政府提供和规范地方服务的权威性。”

这份声明由加拿大汽车工人协会、加拿大劳工大会、加拿大公共就业联盟、钢铁工人联合会、六个省级和地方劳工联合组织以及其他5各工会组织签署。这份声明没有讨论的一个问题是,有组织的劳工们所相信的加拿大制造业目前正从省市级的“购买加拿大货”政策和项目中收益,其边界到什么程度。

2009年12月4日,加拿大媒体报道说:“关于‘购买美国货’争议的处理还有很长一段路要走……但是新的法令正在取得进步,贸易保护主义者的条款正在付诸实施,将最终惠及加拿大。”然而,2010年1月28日,《国家邮报》就刊登了一篇题为《“购买美国货”末日将近》的新闻稿,这篇文章说:

“奥巴马政府内部消息称,一项带有‘购买美国货’内容的协议即将终结,数日内将宣布这一消息。据说奥巴马总统认为未来经济增正的解决之道只能是通过繁荣出口、保持开放市场来取得,而不能通过提高关税壁垒获取。

因为奥巴马先生不能依赖国会通过把加拿大排除在‘购买美国货’规定之外的立法案,这项复杂的工作全靠总统行使执行权,对加拿大经济部门和美国部门一视同仁,这就要求供应链条团结一体而不是一盘散沙。如果这一消息得以证实,该协议将使在美国境内做生意的加拿大公司大大松一口气,更不用提哪些以美国为基地向北部边境出口的公司。因为美国复苏和再投资法案包括所有的钢铁和工业制成品,只要是用复苏计划的资金支付的项目,所用物资必须是在美国境内生产的。”

这篇文章包含的信息并没有立即得到政府官员的确认,也没有其他新闻机构同样报道过。然而,2010年2月5日,几个新闻机构报道,一项有关“购买美国货”的政策即将公布。据《国家邮报》的保尔·维埃拉报道,作为开放市场的回报,加拿大供应商将获得美国政府采购市场的准入,可以在GPA覆盖的37个州得以参加ARRA资金项目的招投标。然而,(加拿大)各省仍然受到(美国)卫生保健、教育和矫正设施等领域对外国投标者设置的限制。由于这个政策在ARRA资金项目方面仍受限制,更广泛协议的谈判正在进行。

获准进入加拿大省级政府采购市场的好处,对美国供应商来说是很明显的,算上例外行业,该市场估计价值大约在1800万美元。

原文:

II. Buy American Legislation

The economic stimulus package included in the American Recovery and Reinvestment Act (ARRA) generally requires that iron, steel, and manufactured goods used in the construction of public works projects funded by the Act are to be made in the United States.[30] On April 3, 2009, the Office of Management and Budget (OMB) issued guidelines on implementing the Buy American provisions of the ARRA.[31] Ian Fergusson of the Congressional Research Service has summarized the provisions of the guidelines that directly affect Canada as follows:

Likely because Canadian provinces and territories have not undertaken any obligations under the AGP, OMB excluded Canada from the list of countries to which U.S. states participating in the AGP have international obligations. This means that for state and local projects funded by federal money from the stimulus bill, there is no obligation to treat Canadian firms in a manner consistent with U.S. obligations under the AGP. Thus, Canadian firms would be ineligible to bid on contracts for iron, steel, and manufactured products procured for public works projects undertaken by state and local governments using federal stimulus money. However, U.S. obligations under the AGP do extend to Canadian firms bidding on federal procurement funded by the ARRA, and Canadian firms would be able to bid for those contracts. Nonetheless, there have been several anecdotal reports in the Canadian press that U.S. contractors and suppliers are increasingly choosing to source domestically in order not to be hassled with complying with Buy American provisions in certain procurements.[32]

The inclusion of the Buy American provisions in the ARRA program has raised great concern at the highest levels in Canada about what is widely seen as rising protectionism in the U.S. This concern was perhaps best demonstrated when, in September of 2009, the Prime Minister traveled to Washington, D.C. to meet with the President and Congressional leaders, to discuss proposals that would result in a waiver for Canadian suppliers.[33] Visits to Capitol Hill by prime ministers are not unprecedented, but they are unusual and Prime Minister Harper’s visit emphasized the importance of the issue to Canada.[34]

Although the U.S. has responded that “the language of the [ARRA] and subsequent implementing regulations were written to be consistent with U.S. obligations under the WTO Agreement on Government Procurement and U.S. free trade agreements including NAFTA,”[35] and that they were not a new form of protectionism,[36] it has appointed a negotiator to explore various alternatives to largely excluding Canadian suppliers from ARRA funds.

Critics of the Canadian complaints have largely blamed the current problem on Canada’s provinces for not agreeing to bind themselves to the AGP and NAFTA.[37] Christopher Sands, a leading expert on Canada-U.S. trade relations, has reportedly suggested that “Canadian officials ‘have done themselves a great deal of damage’ with the Obama administration for the way they’ve handled the Buy American dispute,”[38] and that Canadian officials now realize that they made a mistake in not adding the provinces to the AGP or NAFTA.[39] However, as mentioned above, in fairness to the provinces, it is not clear that their inclusion in the AGP or NAFTA would have guaranteed Canadian suppliers more ARRA-funded contracts, because of the provisions of the AGP and NAFTA that allow set-asides for federal grants.

In June 2010, Prime Minister Harper asked Canada’s provinces to modify their procurement laws to allow U.S. suppliers of goods and services the benefits of the government procurement provisions of NAFTA.[40] The extent to which provincial procurement markets are closed to U.S. firms is not clear because many provincial and municipal restrictions are in the form of policies or are inserted into individual tenders rather than into written laws. Also, in June 2010, the Federation of Canadian Municipalities voted 189 to 175 to bar bids from companies whose countries impose trade restrictions against Canada.[41] This was a nonbinding resolution, but indicates that many Canadian municipalities believed that Canadian firms should have been allowed to bid on goods and services funded by the ARRP even though Canada’s provinces are not listed in the AGP and NAFTA does not cover subcentral entities or grants to subcentral entities by national governments. The actions of the Federation of Canadian Municipalities received widespread media coverage in Canada, but was seen by the federal government of Canada as being more of an expression of disapproval than an effort that would ultimately have a significant impact upon U.S. suppliers.[42]

The only provincial leader to immediately respond positively to the Prime Minister’s request for support of a bilateral agreement on government procurement was the Premier of Quebec.[43] Quebec’s support for the Conservative federal leader was not unexpected because even though it has a Liberal government, Quebec has traditionally been the strongest supporter of NAFTA, in part because it has a relatively large manufacturing base. The group that generally opposed the Prime Minister’s request most vocally was organized labor. For example, in August 2009, the president of the Canadian autoworkers called on the other premiers to reject federal proposals that would eliminate or restrict the provinces’ right to establish purchasing policies intended to benefit the Canadian economy.[44] The diverse labor groups he represented issued a statement, which read as follows:

Rather than attacking these successful and popular “Buy American” policies, Canadian governments should increase and speed up funding for public infrastructure projects and attach “Buy Canadian” conditions to the funding.[45]

We oppose expanding NAFTA to cover all sub-national procurement and the related effort to negotiate a “free trade” deal with the European Union that would also bind sub-national governments to NAFTA-like restrictions. This approach would drain needed stimulus from the Canadian economy, worsen the current crisis in manufacturing and interfere with provincial governments’ authority to provide and regulate local services.

This statement was signed by the Canadian Auto Workers, the Canadian Labour Congress, the Canadian Union of Public Employees, the United Steel Workers, six provincial and territorial Federations of Labour, and five other labor organizations.[46] One issue the statement does not discuss is the extent to which organized labor believes that Canadian manufacturers are currently benefiting from provincial and municipal “buy Canadian” policies or programs.

On December 4, 2009, the Canadian Press reported that “a deal on the Buy American trade dispute is still a long way off … but progress is being made on new rules regarding the implementation of the protectionist provisions that could ultimately benefit Canada.”[47] However, on January 28, 2010, the National Post ran a story entitled “End Near for ‘Buy American.’”[48] This article stated as follows:

Sources within the Obama administration say that an agreement to fix Buy American is close to being concluded and could be announced within days. The President is said to be resolved that future economic growth can only be achieved by boosting exports and keeping markets open, rather than by raising tariff walls.

Because Mr. Obama cannot rely on Congress to pass legislation exempting Canada from Buy American provisions, the complicated deal will rely on the President using his executive power to treat sectors of the Canadian economy as American, by claiming supply chains are so integrated they cannot be separated.

When confirmed, the agreement will be a major relief for Canadian companies doing business in the United States, not to mention for U.S.-based companies who export north of the border. The U.S. Recovery and Reinvestment Act included sections that all iron, steel and manufactured goods used in projects paid for by stimulus funding must be sourced in the United States.[49]

The information contained in this article was not immediately confirmed by government officials or reported by other news organizations. However, on February 5, 2010, a number of news organizations reported that a deal on the Buy American provisions is to be announced soon. According to Paul Viera of the National Post, in return for opening their markets, the Canadian suppliers will have access to the government procurement market and will be able to bid on programs and projects funded by the ARRA in the thirty-seven states covered by the AGP. However, the provinces will reportedly retain restrictions on foreign bids in the fields of health care, education, and correctional facilities. While the deal is reportedly limited to programs and projects funded by the ARRA, negotiations on a broader agreement are continuing.[50]

| Access to the provincial government procurement market could be highly significant to U.S. suppliers. That market has been estimated as being worth approximately US$18 million, including the excluded sectors.[51] |

| 本网拥有此文版权,若需转载或复制,请注明来源于政府采购信息网,标注作者,并保持文章的完整性。否则,将追究法律责任。 |

[table=100%,#ffffff][/table]

作者: zxc1981 时间: 2015-12-14 21:29

政府采购法律和政策(二):加拿大(下)

作者:曹守同 编译 发布于:2015-11-27 16:47:12 来源:美国国会图书馆www.loc.gov

III.该规定在加拿大的实施

加拿大没有“购买加拿大货”的联邦法律,对GPA和NAFTA中所允许的国家级应对规定进行限制,是通过实施这些协议的法案的形式进入加拿大立法体系的。

IV.联邦采购

有报告说,加拿大政府每年大约花费200亿加元(或187亿美元)用于采购货物和服务,绝大多数货物和服务是通过加拿大公共工程和政府服务机构(PWGSC)进行的。加拿大各部可以直接采购5000加元的货物,也可以直接采购服务,对于超过5000加元的合同,他们就必须通过PWGSC进行采购了。

报告称,省级政府几乎花费了总额为180亿加元的钱采购货物和服务。虽然GPA和NAFTA还没有就这个市场的准入做出保证,但这种情况可能在改变。

对于价值在25000加元或以上的货物或服务项目、10万加元以上的绝大多数工程项目和租赁服务、76500加元以上的建筑和机械工程咨询服务项目,加拿大通过MERX公司利用政府电子招标系统(进行采购)。MERX是美迪瑞福互动技术公司旗下附属公司,也为美国招标者提供信息服务。

PWGSC采用合同、持续邀约以及协议供货等三种执行方式购买货物和服务,加拿大政府是如下介绍这三种方法的:

合同

PWGSC与其供应商之间的合同包含一个预置需求或项目范围,设定期限和条件,包括预定的数量、价格或议价基础以及支付日期。在需求是定制化的或者对政府部门独一无二的情况下,合同方式是对供应商最好的办法。

有时候,仅就服务采购来讲,当政府部门不能预先确切定义服务的性质和时限时,PWGSC采取一种“风险授权”制度:风险授权是一种模式化的行政程序,根据现有合同的条款和情况,由供应商在“被要求的同时和时段内”的基础上管理各项工作;换句话说,如果某项服务最终需要,政府将给供应商发送一个任务批准证书,这个任务批准证书界定了服务的范围、时间以及任何一项特别设定(诸如以预先设定的财政限制为基础的预算报告等。)什么情况下适用任务批准证书合同的服务项目,合适的例子就是翻译专业服务、信息专业服务和某些类型的修理和检修服务。

持续邀约

持续邀约是当某一个或多个政府部门不断重复地对同一种货物或服务提出需求时,或者当实际需求(即需求数量和提供服务的数字)事先未知的情况下,比较适用的供应方法,这时货物和服务已经准备就绪。持续邀约在特定时期内,由特定的合格供应商事先就位,他们符合(政府采购项目)的技术标准,包括固定的期限和供货条件等都无法进一步谈判。

持续邀约为政府节省时间和金钱,因为没有必要为每一次采购操作进行单独的招标程序,价格也通常由于批量采购打折扣而降低。政府没必要采购任何货物或服务,直到需求增加,签订新的合同提上日程。通过这种方法采购的供货品目包括食品、燃料、医药设备、备用部件、纸张、办公室设备以及一些专业服务等。

协议供货

协议供货和持续邀约一样,是当从事先设定合格资质的供应商处采购日常所需货物和服务时采用的一种方法,但是政府没有义务采购所有的货物和服务,直到需求出现,签订合同提上日程。

然而,虽然协议供货包括一些固定的条款和条件适用于所有的合同,但不是所有合同条款都是预先决定的,举例来说,价格、议价基础、危险垃圾清理或处置的有关条目和条件等就会根据实际需要或工作期限做进一步的谈判。PWGSC通过用这种方式购买IM/IT专业服务。

PWGSC已经出台了与加拿大政府进行业务的指导目录,这个指导目录采用五个步骤支持中小企业。

V.结语

加拿大已经实施NAFTA和GPA的政府采购有关规定。前者并不覆盖次中央实体,加拿大尚未将任何省份加入后者的附录2,以相互为基础把省级实体绑定到GPA协定上。然而报告显示加拿大和美国已经达成协议改变这个状况。在联邦层面,加拿大根据有关联邦政府采购的有关法律要求行事,例外和豁免来自加拿大两个主要国际贸易协定里包含的内容。加拿大没有“购买加拿大货”法案,联邦政府采购通过由 PWGSC执行 ,联邦各部采购价值低于5000加元的货物或服务时例外。

现在加拿大政府采购中出现的主要问题是美国复苏和再投资法案(ARRA)中所包含的“购买美国货”规定。由于加拿大省级和地方采购未曾加入NAFTA规定的范围,也未将任何省份加入GPA的附录2,因而加拿大起初并未从美国ARRA的“购买美国货”规定获得例外优待。加拿大一直在寻求获得例外待遇,包括《国家邮报》和《卡尔加里先驱报》在内的许多新闻机构都报道说,政府努力将很快取得成功。 (资料由国外法律高级专家史蒂芬·F·克拉克提供)

原文:

III. Canadian Implementing Legislation

Canada does not have a federal “Buy Canadian Act.” The limitations on the national treatment provisions allowed for in the AGP and NAFTA are incorporated into Canadian law through the acts implementing those agreements.[52]

IV. Federal Procurement

The Government of Canada reportedly spends about Can$20 billion or approximately US$18.7 billion a year on Goods and Services.[53] Most goods and services are purchased by Public Works and Government Services Canada (PWGSC). Government departments spend up to Can$5000 on goods and can purchase services directly. For contracts for over Can$5000, they must go through PWGSC.[54]

Provincial governments reportedly spend an almost identical Can$18 billion amount on goods and services. While access to this market has not been guaranteed by the AGP or NAFTA, this situation may be changing.

Canada uses a Government Electronic Tendering Service through MERX for most contracts for goods and services valued at Can$25,000 or more, most construction and leasing services worth Can$100,000 or more, and most architectural and engineering consulting services worth Can$76,500 or more. MERX is a subsidiary of Mediagrif Interactive Technologies, which also provides information on U.S. tenders.[55]

PWGSC buys goods and services using contracts, standing offers, and supply arrangements. The Government of Canada has explained how these three methods are employed in the following terms:

Contracts

Contracts between PWGSC and its suppliers contain a pre-defined requirement or scope of work, and set terms and conditions including pre-determined quantities, prices or pricing basis, and delivery date. A contract is the best method of supply when the requirement is customized and unique to one government department.

Sometimes, for contracts for services only, when the Government is unable to define the precise nature and timing of a service in advance, PWGSC includes a provision for “task authorizations.” A task authorization is a structured administrative process to authorize work by a supplier on an “as and when requested” basis in accordance with the terms and conditions of an existing contract. In other words, when the services are eventually required, the Government issues a task authorization to the supplier. This task authorization identifies the scope of the services, the timing, and any specific instructions (such as expenditure reporting based on pre-established financial limits). Examples of services where task authorization contracts might be considered appropriate are professional services for translation, informatics professional services, and some types of repair and overhaul services.

Standing Offers

Standing offers are the preferred method of supply when one or many government departments repeatedly order the same goods or services, which are readily available, or when the actual demand (i.e. quantity, delivery date) is not known in advance. Standing offers are put in place, for a specific period of time with pre-qualified suppliers who have met the technical criteria, and include set terms and conditions, which cannot be further negotiated.

Standing offers save the Government time and money, as a separate process does not need to be conducted for each purchase and prices are often reduced due to volume discounts. The Government is not obliged to purchase any goods or services until a need arises, at which time a contract is put in place. Items bought through this method of supply include food, fuel, pharmaceutical supplies, spare parts, paper supplies, office equipment, and some professional services.

Supply Arrangements

Supply arrangements, like standing offers, are put in place for goods or services that are purchased on a regular basis from pre-qualified suppliers but the Government is not obliged to purchase any goods or services until a need arises, at which time a contract is put in place.

However, although supply arrangements include some set terms and conditions that will apply to any subsequent contracts, not all are predetermined. For example, prices, pricing basis or terms and conditions for hazardous waste disposal or cleanup may be further negotiated based on the actual requirement or scope of work. PWGSC routinely purchases IM/IT professional services using this method of supply.[56]

PWGSC has published a guide for doing business with the Government of Canada. This guide utilizes a five-step approach for small and medium businesses.[57]

V. Concluding Remarks

Canada has implemented the government procurement provisions of NAFTA and the AGP. The former does not cover subcentral entities and Canada has not yet added any provinces to Annex II of the latter so as to bind the provinces to it on a reciprocal basis. However, Canada and the United States have reportedly reached a deal that could change this situation. On the federal level, Canada has followed the legal requirements respecting federal government procurement, and the exceptions and exemptions its laws allow for are those contained in Canada’s two major international trade agreements. Canada does not have a “Buy Canada” Act. Federal government procurement is generally handled by PWGSC. Exceptions exist for departmental purchases of goods valued at less than Can$5000 and purchases of services.

The major issue in government procurement in Canada today arises out of the inclusion of “Buy American” provisions contained in the ARRA. Because provincial and municipal procurement is not covered by NAFTA and Canada did not add any provinces to Annex II of the AGP, it was not initially given a waiver from the “Buy American” provisions of the ARRA. The Government of Canada has been seeking a waiver for the past eight months, and the National Post and Calgary Herald are two of a number of news organizations that have recently reported that the government’s efforts may soon be successful.

| Prepared by Stephen F. Clarke |

| Senior Foreign Law Specialist |

| 本网拥有此文版权,若需转载或复制,请注明来源于政府采购信息网,标注作者,并保持文章的完整性。否则,将追究法律责任。 |

| 欢迎光临 bbs.ebnew (http://bbs.chinabidding.com/) |

Powered by Discuz! X2.5 |